arni22.ru

Recently Added

Gallons Of Paint Per Square Foot Interior

A: A 5-gallon bucket of paint can cover up to square feet of space. Most interior doors are about 20 square feet. For a 20 square foot door, you need about mL of paint for one coat. How much trim does a gallon of paint cover. In general, you can expect 1 gallon of Benjamin Moore paint to cover about square feet. gallons of paint you need for the walls. You can round. Generally, a gallon of paint will cover square feet. However, depending on the paint you choose to use, it could be more or less. If you already know. In general, you can expect 1 gallon of Benjamin Moore paint to cover about square feet. You need slightly more than a gallon if the walls are unpainted. Divide the total square footage by the coverage rate to find the number of gallons needed. For example, let's find the paint needed to cover square feet. In general, one gallon of paint or primer will cover roughly square feet of surface. Save time and money with the KILZ paint calculator to estimate. Each gallon of paint should be able to cover up to square feet of your home's interior. Keep in mind that two coats of paint are often required. What Kind. A gallon of interior wall paint will cover around square feet, so a wall requiring 4 gallons will be about square feet. If the. A: A 5-gallon bucket of paint can cover up to square feet of space. Most interior doors are about 20 square feet. For a 20 square foot door, you need about mL of paint for one coat. How much trim does a gallon of paint cover. In general, you can expect 1 gallon of Benjamin Moore paint to cover about square feet. gallons of paint you need for the walls. You can round. Generally, a gallon of paint will cover square feet. However, depending on the paint you choose to use, it could be more or less. If you already know. In general, you can expect 1 gallon of Benjamin Moore paint to cover about square feet. You need slightly more than a gallon if the walls are unpainted. Divide the total square footage by the coverage rate to find the number of gallons needed. For example, let's find the paint needed to cover square feet. In general, one gallon of paint or primer will cover roughly square feet of surface. Save time and money with the KILZ paint calculator to estimate. Each gallon of paint should be able to cover up to square feet of your home's interior. Keep in mind that two coats of paint are often required. What Kind. A gallon of interior wall paint will cover around square feet, so a wall requiring 4 gallons will be about square feet. If the.

If you do no know or do not have the paint with you, use sqft per gallon as your simple starting point. Some paints are more some are less. Once you have. In April the cost to Paint a Home starts at $ - $ per square foot. Use our Cost Calculator for cost estimate examples customized to the. Paint per Square Foot. The general rule of thumb is a single 1-gallon can of paint can safely cover up to square feet with a single coat of paint. Paint usually is applied at to square feet per gallon (primer at to square feet per gallon). Use the Area section below to calculate the walls. One gallon can of paint will cover up to square feet, which is enough to cover a small room like a bathroom. Two gallon cans of paint cover. Using the sherwin williams calculator, it estimates that I need 1/2 a gallon to coat the largest room and 1/3 gallon to coat the other rooms. As a general rule of thumb, one gallon of paint can cover approximately square feet of space. That means you can expect to use about a gallon of paint to. According to Lowe's, a gallon of primer covers about – square feet, and a gallon of paint usually covers – square feet. Start by adding up the. TIP: Don't forget, each gallon covers between square feet. Don't forget to factor in the paint for a second coat if necessary. Step 5. To estimate the. As a guideline, one gallon of paint can cover anywhere from square feet of interior walls, for one coat. TIP. Remember wall square footage differs from. Like paint, a gallon can cover to square feet. You can use the same result from the calculator to determine how many gallons you need per coat of primer. We recommend buying 20 percent more paint for a textured surface (so, if you are painting a square-foot room, account for square feet). Everything you. A one gallon ( liter) can of wall paint covers about – square feet (35 to 37 square meters). Calculate one room at a time and determine if you. Fill in the blanks below, and click 'Calculate' to determine the right amount of paint for your project with our custom paint calculator. Wall 1. Height. Feet. In April the cost to Paint a Home starts at $ - $ per square foot. Use our Cost Calculator for cost estimate examples customized to the. As a rule of thumb, homeowners should budget for approximately one gallon of paint per square feet of wall space. Interior Paint Prices Per Square Foot. Estimating Your DIY Costs · For example, you can cover square feet (79 m2) with gallons ( L) of paint (or 3 gallons (11 L), rounding up to the. For example, if the paint you've chosen covers square feet per gallon and you're painting a room with a total surface area of square feet, you'll need. One gallon of Interior BEHR ULTRA® SCUFF DEFENSE™ Paint and Primer, or BEHR PREMIUM PLUS® is enough to cover to Sq. Ft. of surface area with one coat. A one gallon ( litre) can of wall paint covers about – square feet (35 to 37 square metres). Example: Your room to be painted is 12' x 14' with 8'.

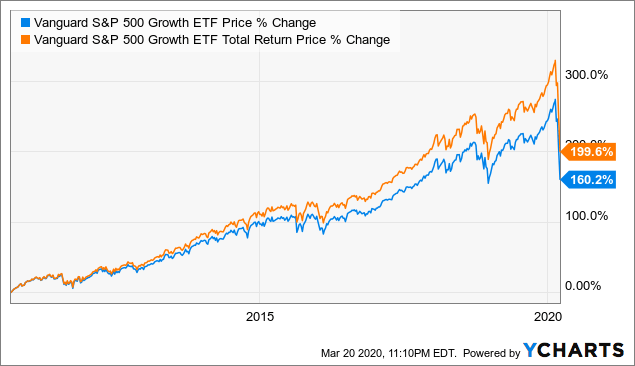

S&P Index Vs Etf

This means the price you pay for shares of an ETF may be more closely aligned with the market it mirrors than those of an index fund. It can give investors more. The Fund will invest at least 90% of its total assets in securities that comprise the Index. The Index is composed of 50 of the largest companies in the S&P. ETFs often generate fewer capital gains for investors than mutual funds. This is partly because so many of them are passively managed and don't change their. For over 20 years, our renowned SPIVA research has measured actively managed funds against their index benchmarks worldwide. An index fund (also index tracker) is a mutual fund or exchange-traded fund (ETF) designed to follow certain preset rules so that it can replicate the. ETFS are more tax efficient and trade flexible and would perform better in a taxable brokerage accounts. Index Funds are better in tax-deferred. The difference of course is that ETFs are "exchange traded." That means you can buy and sell them intraday, like any other stock. By contrast, you can only buy. Considering an investment in the S&P Options are numerous but considering: HSBC American Index C Acc or Vanguard S&P ETF USD Acc. The primary difference between ETFs and index funds is how they're bought and sold. ETFs trade on an exchange just like stocks, and you buy or sell them through. This means the price you pay for shares of an ETF may be more closely aligned with the market it mirrors than those of an index fund. It can give investors more. The Fund will invest at least 90% of its total assets in securities that comprise the Index. The Index is composed of 50 of the largest companies in the S&P. ETFs often generate fewer capital gains for investors than mutual funds. This is partly because so many of them are passively managed and don't change their. For over 20 years, our renowned SPIVA research has measured actively managed funds against their index benchmarks worldwide. An index fund (also index tracker) is a mutual fund or exchange-traded fund (ETF) designed to follow certain preset rules so that it can replicate the. ETFS are more tax efficient and trade flexible and would perform better in a taxable brokerage accounts. Index Funds are better in tax-deferred. The difference of course is that ETFs are "exchange traded." That means you can buy and sell them intraday, like any other stock. By contrast, you can only buy. Considering an investment in the S&P Options are numerous but considering: HSBC American Index C Acc or Vanguard S&P ETF USD Acc. The primary difference between ETFs and index funds is how they're bought and sold. ETFs trade on an exchange just like stocks, and you buy or sell them through.

A passively managed fund aims to mimic the performance of a specific market benchmark or index — such as the S&P — and is made up exclusively of the. S&P index funds are among the most popular investment choices in the U.S. thanks to their low cost, minimal turnover rate, simplicity and performance. They work in one of two ways. Most ETFs are designed to track the performance of an index, sector, or commodity. Some are actively managed. These ETFs do not. How does RSP differ from other S&P Equal Weight funds? Although most ETFs—and many mutual funds—are index funds, the portfolio managers are still there to make sure the funds don't stray from their target indexes. Treasuries, Crude oil and Gold trade times greater dollar value than ETFs each day. CME's S&P futures outtrades the top S&P ETFs around the world. Both are, essentially, index funds that follow the same index. There are technical differences between how they operate, how you buy and sell them, and. The iShares S&P Index ETF seeks to provide long-term capital growth by replicating, to the extent possible, the performance of the S&P Index. The iShares Core S&P ETF seeks to track the investment results of an index composed of large-capitalization U.S. equities. iShares Core S&P ETF; Schwab S&P Index Fund; Shelton NASDAQ Index Direct; Invesco QQQ Trust ETF; Vanguard Russell ETF; Vanguard Total Stock. If I invested to a S&P ETF and a S&P index fund, would I be earning the same amount say in about 40 years? We're returning our focus to "vanilla" S&P ETFs with the Vanguard S&P ETF (VOO). It's smaller than the previously mentioned IVV and SPY at $ billion. The iShares Core S&P ETF seeks to track the investment results of an index composed of large-capitalization US equities. ETFs allow you to invest in a broad segment of a market, like the S&P or the Dow, or in the market as a whole. Because they are designed to mimic an index. Cost of S&P ETFs The total expense ratio (TER) of S&P ETFs is between % p.a. and % p.a.. In comparison, most actively managed funds do cost. ETFs tend to have lower fees and no minimum investment, making them a low-cost alternative for many portfolios. However, investors should be mindful of trading. S&P index funds are among the most popular investment choices in the U.S. thanks to their low cost, minimal turnover rate, simplicity and performance. The average expense ratio is %. S&P ETFs can be found in the following asset classes: Equity. The largest S&P ETF is the. ETFs are similar to index funds, but ETFs have important and notable differences. Learn more about the differences between ETFs and index funds.

Most Popular Male Sunglasses

To help you zero in on the right shades for you, this guide will share the top trending sunglasses styles for men. Let's find your next look! If ever in doubt, the classic Wayfarer is a universal style that works for almost all men, so start from there. Frames. Cubitts. When comparing frames, consider. I wear Maui Jim, Persols, and Ray Ban. Of those three MJ is my favorite for comfort and lenses. My persols also have absolutely amazing lenses. Browse all sunglasses bestsellers from Gentle Monster and shop the hottest sunglasses They help us to know which pages are the most and least popular and see. VERSACE Men's Sunglasses: explore finely crafted eyewear, add luxury to any outfit. Choose classic aviators, bold cat-eye frames, or sporty styles. Frame Colour · Men's Maverick Aviator Sunglasses in Black · Men's Bayer Aviator Sunglasses in Nickel · Men's Amar Aviator Sunglasses in Nickel and Grey · Men's Joey. Discover the best Men's Sunglasses in Best Sellers. Find the top most popular items in Amazon Clothing, Shoes & Jewelry Best Sellers. Persol Most Popular Sunglasses. (26) · SM - Steve McQueen. 5 colors. 5 / 5 colors · POS. 3 colors. 3 / 3 colors · POS. 7 colors. 7 / 7 colors · POS. Celebrity designed sunglasses for men starting at $ Premium features with every order. Shop classy navigators, bold shield frames, edgy rimless and more. To help you zero in on the right shades for you, this guide will share the top trending sunglasses styles for men. Let's find your next look! If ever in doubt, the classic Wayfarer is a universal style that works for almost all men, so start from there. Frames. Cubitts. When comparing frames, consider. I wear Maui Jim, Persols, and Ray Ban. Of those three MJ is my favorite for comfort and lenses. My persols also have absolutely amazing lenses. Browse all sunglasses bestsellers from Gentle Monster and shop the hottest sunglasses They help us to know which pages are the most and least popular and see. VERSACE Men's Sunglasses: explore finely crafted eyewear, add luxury to any outfit. Choose classic aviators, bold cat-eye frames, or sporty styles. Frame Colour · Men's Maverick Aviator Sunglasses in Black · Men's Bayer Aviator Sunglasses in Nickel · Men's Amar Aviator Sunglasses in Nickel and Grey · Men's Joey. Discover the best Men's Sunglasses in Best Sellers. Find the top most popular items in Amazon Clothing, Shoes & Jewelry Best Sellers. Persol Most Popular Sunglasses. (26) · SM - Steve McQueen. 5 colors. 5 / 5 colors · POS. 3 colors. 3 / 3 colors · POS. 7 colors. 7 / 7 colors · POS. Celebrity designed sunglasses for men starting at $ Premium features with every order. Shop classy navigators, bold shield frames, edgy rimless and more.

Cool Aviators. Aviator sunglasses are one of the most popular styles for men because they exude confidence and attitude. Originally designed for fighter pilots. Check out our great selection of polarized sunglasses and great brands including: Electric, VonZipper, Oakley, Dragon, Ray-Ban and more. Men's sunglasses for summer. Man riding motorcycle wearing best selling Knoxville sunglass frame. All Men's Sunglasses. Home / All Men's Sunglasses. Sort. Sort. We carry designer sunglasses and prescription sunglasses for men in top brands, including Ray-Ban, Versace, Persol, and Prada. As an authorized dealer. Maui Jim offers a large selection of polarized sunglasses for men in a variety of styles. View our most popular men's sunglasses. Persol Most Popular Sunglasses. (26) · SM - Steve McQueen. 5 colors. 5 / 5 colors · POS. 3 colors. 3 / 3 colors · POS. 7 colors. 7 / 7 colors · POS. Men's sunglasses for summer. Man riding motorcycle wearing best selling Knoxville sunglass frame. All Men's Sunglasses. Home / All Men's Sunglasses. Sort. Sort. Men's Best Sellers · Canyon $34 $49 · Millenia DX $89 · Canyon $34 $49 · Millenia X2 $41 $59 · Canyon $34 $49 · H Series $34 $49 · Millenia X2 $41 $59 · Canyon $34 $ Copper, green, and blue lenses are the most popular for polarized sunglasses for men. Wiley X Polarized sunglasses for men provide a. The slick shades Maverick wears in Top Gun are a staggering 50% off. Since , GQ has inspired men to look sharper and live smarter with its unparalleled. The best men's sunglasses with retro styling · 9. Ray-Ban CLUBMASTER · Ray-Ban RB · Oakley EYEJACKET REDUX · Christian Roth OSKARI · David. Shop great sunglasses for men. Polarized lenses, durable frames, free shipping qualifying orders and free returns on standard U.S. orders. Shop all official Ray-Ban® Men's Sunglasses at the Ray-Ban® online store. Choose from the coolest new and classic frames, lenses and colors. Men's Best Sellers · Canyon $34 $49 · Millenia DX $89 · Canyon $34 $49 · Millenia X2 $41 $59 · Canyon $34 $49 · H Series $34 $49 · Millenia X2 $41 $59 · Canyon $34 $ Filter · TOM FORD. Damian Aviator Sunglasses. $ · TOM FORD. Tex Aviator Sunglasses. $ · TOM FORD. Snowdon Square Sunglasses. $ · TOM FORD. Huxley Aviator. Men's Sunglasses · Frame Colour · Men's Maverick Aviator Sunglasses in Black · Men's Sadie Oval Sunglasses in Light Gold · Men's Bayer Aviator Sunglasses in Nickel. Experience the perfect fusion of quality and style, designed for those who live life on their own terms. Read More View More Most searched products: Men's Glasses: Shop Stylish Frames from Top Brands. At Eyeconic, you can easily find new men's eyeglasses that suit your style. Gone are the days of one-size-. We carry designer sunglasses and prescription sunglasses for men in top brands, including Ray-Ban, Versace, Persol, and Prada. As an authorized dealer. Shop great sunglasses for men. Polarized lenses, durable frames, free shipping qualifying orders and free returns on standard U.S. orders.

Purchase Plans

Purchase planning is the process of establishing objectives and tactics to obtain the best value in a specific purchase. Purchasing Savings Plans. You can access Savings Plans in the AWS Billing and Cost Management console, or directly by opening the AWS Cost Management. Money purchase plans have required contributions. The employer is required to make a contribution to the plan each year for the plan participants. Investing with Invest Online is simple. In five easy steps you provide Invest Online with the data it needs to execute your stock purchase order. You can browse plans and estimated prices here any time. Next, you can log in to apply, see final prices, pick a plan, and enroll. With Microsoft , get online protection, secure cloud storage, and innovative apps all in one plan. Buy now. Microsoft suite of apps such as Teams, Word. An employee stock purchase plan (ESPP)1 is an optional program that allows you to buy shares of your company's stock at a discounted price. Purchase College meal plans provide the ultimate in convenience and flexibility. With your meal plan, you have the freedom to dine anywhere on campus. An employee stock purchase plan, (ESPP) is a type of broad-based stock plan that allows employees to use after-tax payroll deductions to acquire their company'. Purchase planning is the process of establishing objectives and tactics to obtain the best value in a specific purchase. Purchasing Savings Plans. You can access Savings Plans in the AWS Billing and Cost Management console, or directly by opening the AWS Cost Management. Money purchase plans have required contributions. The employer is required to make a contribution to the plan each year for the plan participants. Investing with Invest Online is simple. In five easy steps you provide Invest Online with the data it needs to execute your stock purchase order. You can browse plans and estimated prices here any time. Next, you can log in to apply, see final prices, pick a plan, and enroll. With Microsoft , get online protection, secure cloud storage, and innovative apps all in one plan. Buy now. Microsoft suite of apps such as Teams, Word. An employee stock purchase plan (ESPP)1 is an optional program that allows you to buy shares of your company's stock at a discounted price. Purchase College meal plans provide the ultimate in convenience and flexibility. With your meal plan, you have the freedom to dine anywhere on campus. An employee stock purchase plan, (ESPP) is a type of broad-based stock plan that allows employees to use after-tax payroll deductions to acquire their company'.

An employee stock purchase plan allows you to buy company stock at a bargain price. Discounts usually range from 5% to 15%. Log in to your Schwab One® brokerage account and choose "Equity Awards" from the navigation bar on the Accounts page. Select "Manage ESPP" in the right column. An employee stock purchase plan allows you to buy company stock at a bargain price. Discounts usually range from 5% to 15%. An Employee Stock Purchase Plan is a program offered by many public companies that allows employees to purchase shares of the company's stock, often at. Employee stock purchase plans (ESPPs) enable employees to buy company stock at a discounted rate, such as 15 percent. The plans offer a potential financial. Purchase College meal plans provide the ultimate in convenience and flexibility. With your meal plan, you have the freedom to dine anywhere on campus. An ESPP must provide that all of an employee's ESPP options (under all ESPP plans sponsored by the employer and its related companies) may not vest and become. An employee stock purchase plan is a valuable benefit offered by some publicly traded companies. It allows employees to purchase company shares at a discount. Log in to your Schwab One® brokerage account and choose "Equity Awards" from the navigation bar on the Accounts page. Select "Manage ESPP" in the right column. Because a money purchase plan consists solely of employer money, many employers require a participant to remain employed for a period of time before the account. PURCHASE PLANS means the Deferred Sales Charge Purchase Plan, the Fee Based Accounts Purchase Plan, the Front Load Purchase Plan and the Low Load Purchase Plan. An Employee Stock Purchase Plan (ESPP) is the easiest and often the most cost-effective way for employees to purchase shares in your company. An Employee Stock Purchase Plan is a program offered by many public companies that allows employees to purchase shares of the company's stock, often at. Employee Stock Purchase Plan (ESPP) Design. Employee stock purchase plans (ESPPs) are again on the rise. When broad-based granting budgets tighten, ESPPs are a. Summary · A Direct Stock Purchase Plan (DSPP) is a way for individuals to buy stocks directly from a company rather than through a brokerage. · Through a DSPP. An employee stock plan provides your people with a convenient way to purchase your company's stock through payroll deductions. We partner with you to oversee. An ESPP provides the opportunity for employees to purchase shares of the company's common stock through accumulated after-tax payroll deductions. These plans. An employee stock purchase plan (ESPP) is a means by which employees of a corporation can purchase the corporation's capital stock. An employee stock purchase plan (ESPP) is a means by which employees of a corporation can purchase the corporation's capital stock. plans. Add generative features to Acrobat Pro, Acrobat Standard, or Acrobat Reader by purchasing the AI Assistant for Acrobat plan. Buying for a team? Easy.

Can I Withdraw Cash Value From Life Insurance

:max_bytes(150000):strip_icc()/6-ways-capture-cash-value-life-insurance.asp_Final-c7bb8ff0835a45a9b024cb5206bdd670.png)

Option 1: Withdraw your entire cash value. Let's say you have a whole life policy you have been paying into for a while and you want or need money. · Option 2. You can surrender the policy and exchange it for the value. You can take a loan against the cash value, which may or may not incur interest, depending on the. Withdrawals: Policyholders can withdraw money from their cash value at any time, for any reason. This can be useful in times of financial need or for planned. You can tap into your policy's cash value by making a withdrawal or taking a loan against your policy. It is important to understand that policy loans and. I know this may get some down votes, but at this point your cash value is an asset on your balance sheet and you can use it. If I were you, I. When you withdraw funds or loan money from a cash value life insurance policy it can alter the policy's death benefit. When you take out a policy loan and fail. You can take money out OR you can cancel the policy and they have to pay you whatever is left in the account. Now here are the things they don't. The policy owner can often access this value via the surrender of the policy, a loan or partial withdraw. Note that not all policies offer all the access to. Withdrawal In most situations, you can take a cash withdrawal from your permanent life policy, and that money will not be subject to income taxes if it's less. Option 1: Withdraw your entire cash value. Let's say you have a whole life policy you have been paying into for a while and you want or need money. · Option 2. You can surrender the policy and exchange it for the value. You can take a loan against the cash value, which may or may not incur interest, depending on the. Withdrawals: Policyholders can withdraw money from their cash value at any time, for any reason. This can be useful in times of financial need or for planned. You can tap into your policy's cash value by making a withdrawal or taking a loan against your policy. It is important to understand that policy loans and. I know this may get some down votes, but at this point your cash value is an asset on your balance sheet and you can use it. If I were you, I. When you withdraw funds or loan money from a cash value life insurance policy it can alter the policy's death benefit. When you take out a policy loan and fail. You can take money out OR you can cancel the policy and they have to pay you whatever is left in the account. Now here are the things they don't. The policy owner can often access this value via the surrender of the policy, a loan or partial withdraw. Note that not all policies offer all the access to. Withdrawal In most situations, you can take a cash withdrawal from your permanent life policy, and that money will not be subject to income taxes if it's less.

Surrender value refers to the amount a person would receive if they withdraw money from their own life insurance policy's cash value. can withdraw funds from. This is called a withdrawal. However, some policies may restrict when and how much cash value you can withdraw. Some policies may have a minimum withdrawal. Instead of your beneficiaries receiving the death benefit, you as the policyholder will receive the cash value your whole life insurance policy has built up. Withdrawals: You can take withdrawals from the policy's available cash value without interest charges. A withdrawal charge may apply and any policy. In certain types of policies, you can take a policy withdrawal from the accumulated cash value in your policy. Since this method reduces the total cash value. Yes. You can easily take money out of the cash value of your life insurance policy as a tax-free withdrawal up to the amount you've paid in premiums;. You can withdraw the money to help pay for retirement or to pay your life insurance premiums. You can also take out a loan against the cash value of the policy. How do I cash in a life insurance policy? · Use the cash value to pay your premiums · Make a partial withdrawal · Borrow against the policy · Surrender the policy. As your policy's accumulated cash value grows, you can use it to make premium payments, borrow money, or even withdraw cash. How does cash value life. You have the option, with cash value, to surrender your policy and withdraw the total cash value of your policy. If you do surrender your policy though, you. One can do this by taking out a loan against the policy, surrendering the policy, or making a withdrawal Types of Life Insurance Policies with Cash Value. Withdrawals: Policyholders can withdraw money from their cash value at any time, for any reason. · Loans: Another option is to take out a loan against your cash. Please be advised that a withdrawal against your universal life policy may cause the policy to lapse if it is not adequately funded. As well, this transaction. If your policy does allow such withdrawals, any withdrawal you make will typically be tax free up to your basis in the policy. Your basis is the amount of. Both types of life insurance provide death benefit coverage. While term life insurance offers protection that is designed to last for a specific period of. You may be able to make a tax-free withdrawal from your permanent life insurance policy. But, if your withdrawal exceeds the amount you've paid so far into the. Withdrawal: You can withdraw a portion of the cash value. Keep in mind that withdrawing more than you've paid in premiums could be taxable. Loan: You can take a. The cash value within a life insurance policy represents the equity that is tied to the death benefit. It acts similarly to the equity you hold. You can use your cash value by borrowing against it, withdrawing some of it, or withdrawing it all at once and surrendering the policy. (Withdrawals over. When you borrow against your policy, you take a loan from the life insurance company with your cash value as collateral. When you do this, you usually have your.

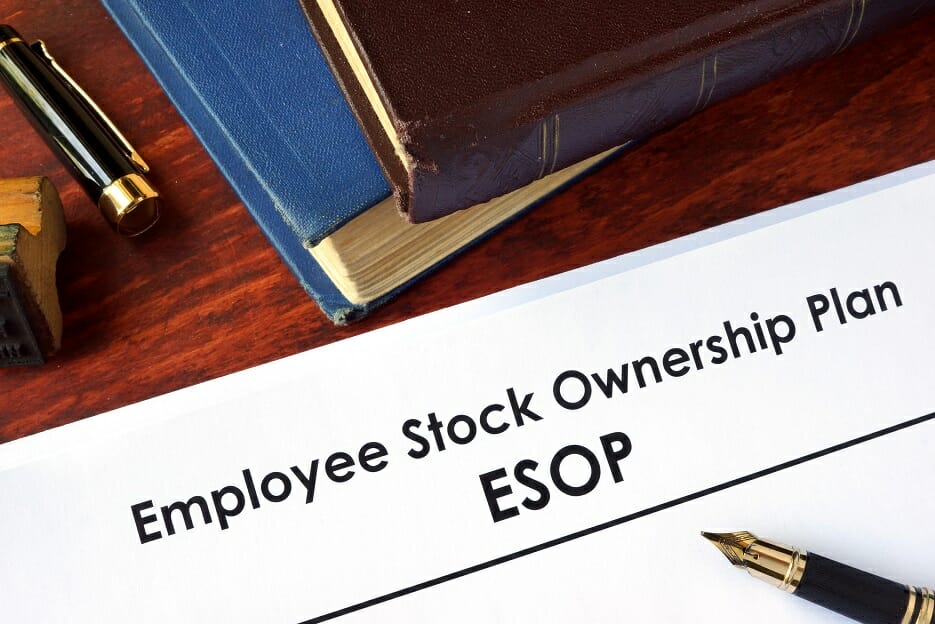

What Is An Employee Stock Ownership Plan

An Employee Stock Ownership Plan (ESOP) refers to an employee benefit plan that gives the employees an ownership stake in the company. An Employee Stock Ownership Plan (ESOP) is an employer provided qualified retirement plan that provides the employees an ownership interest in the company. An ESOP is an employee benefit plan that enables employees to own part or all of the company they work for. ESOPs are most commonly used to facilitate. Harris & Associates is a % employee owned ESOP S-corporation. The Iowa Economic Development Authority (IEDA) helps Iowa business owners complete the first step of setting up an ESOP - a feasibility study conducted by. Old Plank Trail Community Bank's ESOP professionals ensure a smooth transition to employee ownership. An ESOP involves the sale of some or all of a business to its employees,” explains Brian Roth, National Executive, ESOP Finance and Advisory at Bank of America. A useful tool to attract and retain employees · The percentage of a company's shares reserved for stock options will typically vary from 5% to 15% · A senior. How ESOPs Work Companies set up a trust fund for employees and contribute either cash to buy company stock, contribute shares directly to the plan, or have. An Employee Stock Ownership Plan (ESOP) refers to an employee benefit plan that gives the employees an ownership stake in the company. An Employee Stock Ownership Plan (ESOP) is an employer provided qualified retirement plan that provides the employees an ownership interest in the company. An ESOP is an employee benefit plan that enables employees to own part or all of the company they work for. ESOPs are most commonly used to facilitate. Harris & Associates is a % employee owned ESOP S-corporation. The Iowa Economic Development Authority (IEDA) helps Iowa business owners complete the first step of setting up an ESOP - a feasibility study conducted by. Old Plank Trail Community Bank's ESOP professionals ensure a smooth transition to employee ownership. An ESOP involves the sale of some or all of a business to its employees,” explains Brian Roth, National Executive, ESOP Finance and Advisory at Bank of America. A useful tool to attract and retain employees · The percentage of a company's shares reserved for stock options will typically vary from 5% to 15% · A senior. How ESOPs Work Companies set up a trust fund for employees and contribute either cash to buy company stock, contribute shares directly to the plan, or have.

An Employee Stock Ownership Plan (ESOP) is an IRC section (a) qualified defined contribution plan which allows employees to own stock in the company fo. An Employee Stock Ownership Plan (ESOP) is a tax-qualified retirement plan authorized and encouraged by federal tax and pension laws. An employee stock ownership plan, or ESOP, is an attractive employee benefit plan and corporate financing tool, which allows employees to become beneficial. Harris & Associates is a % employee owned ESOP S-corporation. An Employee Stock Ownership Plan (ESOP) is a tax-qualified retirement plan authorized and encouraged by federal tax and pension laws. AMERICAN SYSTEMS is % employee-owned. Through our Employee Stock Ownership Plan (ESOP), a qualified retirement plan, employees gain shares in the company. An Employee Stock Ownership Plan (ESOP) is an employer provided qualified retirement plan that provides the employees an ownership interest in the company. An Employee Stock Ownership Plan (ESOP) in the United States is a defined contribution plan, a form of retirement plan as defined by (e)(7)of IRS codes. The Employee Stock Ownership Plan (ESOP) is our way of ensuring you see and benefit from your hard work firsthand by giving you shares of Raymond James stock. An employee stock ownership plan, known as an ESOP, or employee share ownership, can show up in the form of an investment opportunity, an incentive or. An employee stock ownership plan (ESOP) is a retirement plan in which an employer contributes its stock to the plan for the benefit of the company's employees. US employees typically acquire shares through a share option plan. In the UK, Employee Share Purchase Plans are common, wherein deductions are made from an. An employee stock ownership plan (ESOP) is a retirement plan in which an employer contributes its stock to the plan for the benefit of the company's. Employer contributions to an ESOP are tax-deductible, generally up to 25% of employee payroll per year. The employer may also be able to deduct dividends paid. The purpose of an ESOP is to enable employees to acquire beneficial ownership in their Company without having to invest their own money. What is an employee stock ownership plan (ESOP)?. An ESOP is a tax-advantaged retirement plan that allows workers to earn shares in the company they work for as. We provide accounting, tax, and consulting services ranging from acquisition assistance and repurchase planning to sustainability analysis and restructuring. ACCO's ESOP is a free benefit available to all non-signatory employees of the company and its' subsidiaries that meet the eligibility requirements. As an ACCO. Eligible employees earn shares over time, and when they retire or leave the company, they receive their shares as an ESOP distribution, which the ESOP buys back. Unlike a (k), an ESOP is designed to mainly hold company stock; it can hold any percentage of the company and often owns %. Employees do not hold stock.

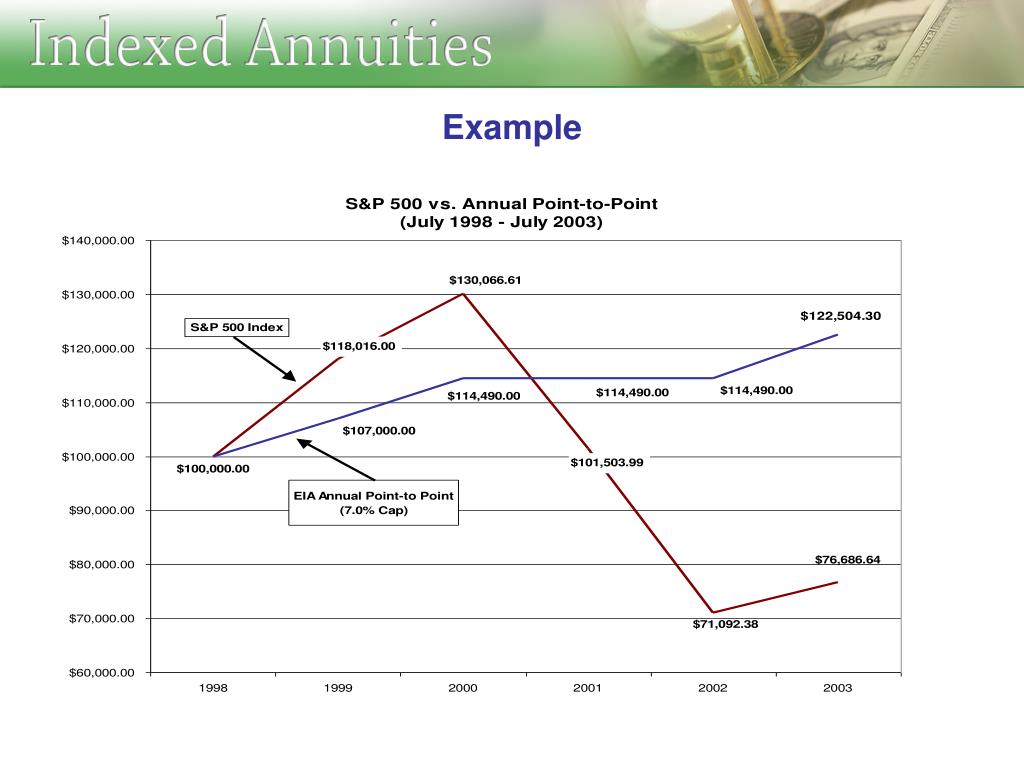

Fixed Annuity Example

Compare Schwab's fixed deferred annuities: · New York Life Secure Term Choice Fixed Annuity II · MassMutual Stable Voyage · Midland National LiveWell® Guarantee. The trade-off with fixed annuities is that an owner could miss out on any changes in market conditions that could have been favorable in terms of returns, but. A fixed annuity provides fixed-dollar income payments backed by guarantees in the contract. During the accumulation period of a fixed deferred annuity, your. Use this calculator to help you determine how a Fixed Annuity might fit into your retirement plan. Fixed annuity. The insurance company promises you a minimum rate of interest and a fixed amount of periodic payments. Fixed annuities are regulated by state. The time period may be a fixed period, such as 20 years, or perhaps for the rest of the client's life. Some annuities may even guarantee a payout for your. For example, the Guardian Fixed Target Annuity SM offers a guaranteed rate of return for three-to-ten year periods (all may not be available at all times). You. Fixed annuities provide regular, guaranteed payments. The interest rate is fixed and predetermined, making them low-risk. The two main types of fixed annuities are life annuities and term certain annuities. Life annuities pay a predetermined amount each period until the death of. Compare Schwab's fixed deferred annuities: · New York Life Secure Term Choice Fixed Annuity II · MassMutual Stable Voyage · Midland National LiveWell® Guarantee. The trade-off with fixed annuities is that an owner could miss out on any changes in market conditions that could have been favorable in terms of returns, but. A fixed annuity provides fixed-dollar income payments backed by guarantees in the contract. During the accumulation period of a fixed deferred annuity, your. Use this calculator to help you determine how a Fixed Annuity might fit into your retirement plan. Fixed annuity. The insurance company promises you a minimum rate of interest and a fixed amount of periodic payments. Fixed annuities are regulated by state. The time period may be a fixed period, such as 20 years, or perhaps for the rest of the client's life. Some annuities may even guarantee a payout for your. For example, the Guardian Fixed Target Annuity SM offers a guaranteed rate of return for three-to-ten year periods (all may not be available at all times). You. Fixed annuities provide regular, guaranteed payments. The interest rate is fixed and predetermined, making them low-risk. The two main types of fixed annuities are life annuities and term certain annuities. Life annuities pay a predetermined amount each period until the death of.

The different types of annuities—fixed, variable and indexed—come with different risks and potential rewards. Take time to learn the differences and compare. Use this calculator to help you determine how a Fixed Annuity might fit into your retirement plan. Fixed deferred annuities are issued by insurance companies and are not insured by the U.S. government. They are backed by the claims paying ability of the. Fixed indexed annuities are contracts purchased from a life insurance company. They are designed for long-term retirement goals. Withdrawals are subject to. For example, if you purchase a 3-year fixed annuity, your contract will show the guaranteed rate of interest you will receive for those three years as well as. A fixed index annuity may be a good choice if you want the opportunity to earn indexed interest, but don't want to risk losing money in the market. During the accumulation period of a fixed deferred annuity, your money, less any applicable charges, earns interest at rates set by the insurance company or in. Insurance companies use different formulas to calculate the interest to add to your annuity. They look at changes in the index over a period of time. See the. Use this calculator to help you determine how a fixed annuity might fit into your retirement plan. The time period may be a fixed period, such as 20 years, or perhaps for the rest of the client's life. Some annuities may even guarantee a payout for your. For example, an annuity may use one value if annuity pay- ments are for retirement benefits and a different value if the annuity is surrendered. As another. Fixed Rate Annuity Calculator Calculate your estimated interest earned over a select period of time demonstrating how a fixed single-premium deferred annuity. In a fixed annuity, the insurance company guarantees the principal and a minimum rate of interest. In other words, as long as the insurance company is. Unlike fixed annuities, variable annuities pay out a fluctuating amount based on the investment performance of assets (usually mutual funds) in an annuity. This. Income annuities can provide the confidence that you will have guaranteed retirement income for life or a set period of time. Fixed-Indexed Annuity Example For example, imagine Alex, a year-old small business owner who is planning for retirement and looking for a balance between. A life annuity can offer guaranteed retirement income payments for as long as you live. This annuity calculator will estimate how much income you can get and. The calculation of an annuity follows a formula: Future Value of an Annuity =C (((1+i)^n - 1)/i), where C is the regular payment, i is. Examples of annuities are regular deposits to a savings account, monthly home mortgage payments, monthly insurance payments and pension payments. Fixed annuities are insurance products which protect against loss and generally offer fixed rates of return. The rates are typically based on the current.

Insurance For Electronic Devices

Our policy gives you the best coverage against accidental loss or damage to electronic equipment, from computers and laptops to electronic accessories. The sum. Protect your smartphone, tablet, computer, or other device from theft, screen cracks, spills, & more. Get your quote for electronic device insurance today. type of device, price of the device, etc. Our policies start as low as $2/month, so protecting your electronics could be cheaper than a coffee a month. Allstate phone protection plus. Phone coverage, tech support, identity theft recovery and roadside assistance available in an affordable bundle-priced plan. buy. Protect your mobile phone, tablet, or other device with insurance. Our local agents can get you multiple insurance quotes to save you time and money. Portable Electronics Insurance Agent · How Can I Get A License? · Authorizing Act · Requirements For Licensees and Endorsees · Conditions to Selling Portable. American Home Shield's Electronics Protection Plan covers TVs, laptops, printers, consoles & more. Protects against power surges and defects. Coverage against all accidental damages and natural calamities like fire, lightning, explosion, war, cyclone, earthquake, flood, landslide, rock slide etc. Protect your purchases with an affordable and high-quality coverage from Upsie. Get insurance for phones, laptops, appliances, fitness equipment and more! Our policy gives you the best coverage against accidental loss or damage to electronic equipment, from computers and laptops to electronic accessories. The sum. Protect your smartphone, tablet, computer, or other device from theft, screen cracks, spills, & more. Get your quote for electronic device insurance today. type of device, price of the device, etc. Our policies start as low as $2/month, so protecting your electronics could be cheaper than a coffee a month. Allstate phone protection plus. Phone coverage, tech support, identity theft recovery and roadside assistance available in an affordable bundle-priced plan. buy. Protect your mobile phone, tablet, or other device with insurance. Our local agents can get you multiple insurance quotes to save you time and money. Portable Electronics Insurance Agent · How Can I Get A License? · Authorizing Act · Requirements For Licensees and Endorsees · Conditions to Selling Portable. American Home Shield's Electronics Protection Plan covers TVs, laptops, printers, consoles & more. Protects against power surges and defects. Coverage against all accidental damages and natural calamities like fire, lightning, explosion, war, cyclone, earthquake, flood, landslide, rock slide etc. Protect your purchases with an affordable and high-quality coverage from Upsie. Get insurance for phones, laptops, appliances, fitness equipment and more!

What's Included? Fire. Coverage against all accidental damages and natural calamities like fire, lightning, explosion, war, cyclone, earthquake, flood. A standard homeowners insurance policy may cover many electronics, including tablets, computers, TVs, and video game consoles if they break or are damaged in. For $ per month, you can get whole home device protection, tech support, data security, and more—all in one plan. We cover theft of your device from, and away from, your home. Accidental damage We cover accidental damage to your device, including cracked screens and liquid. Protect your mobile phone, tablet, or other device with insurance. Our local agents can get you multiple insurance quotes to save you time and money. You can also call to get help from a specialist to transfer coverage from one device to another. Get more Protection with your ultimate electronics plan · PROTECTION PLAN COVERAGE INCLUDES: * · Defects in workmanship and materials · UNLIMITED electronic. Electronic equipment insurance covers the cost to repair or replace specified electronic equipment following a breakdown. Compare quotes and buy online. Trust Assurant's Extended Warranty Program · 1st to offer. a mobile device protection product in the U.S. · 1st to bundle. financing, trade-in/upgrade, and device. Looking for an extended warranty and Insurance to cover your other electronic devices? Get a three year electronics insurance plan for $ Call us now!! Liberty Mutual has a "home computer endorsement" which has a $ deductible when paired with renters insurance. It covers smart watches. The OneTrip Premier Plan, for instance, includes up to $2, in coverage for baggage loss or damage. If you travel frequently for business and you need your. Repair and replacement coverage for accidental damage to electronics, gadgets and personal goods offered during checkout on e-Commerce platforms or offline in-. The good news is that Lemonade homeowners and renters insurance policies do cover electronic devices like smartphones, ereaders, laptops, and broken TVs in the. Your insurance has standard coverage for electronics, but there is usually a $1, limit. This is especially true for portable electronics like smartphones. INSURED PROPERTY. If the Declaration Page shows that Electronic Equipment Coverage - Broad Form applies, we insure. ELECTRONIC EQUIPMENT as defined and as. School Device Coverage insures school issued laptops, iPads, Chromebooks and other electronics issued to students through school or district run programs. Shield your devices with comprehensive insurance protection plans. From laptops and tablets to phones and smartwatches, these plans offer unlimited claim. Depending on the applicable option, this endorsement changes the coverage under Section B of the insurance contract for “electronic equipment” that is not “. Results · ASURION 3 Year Electronics Protection Plan ($ - $) · ASURION 3 Year Electronics Protection Plan ($ - $) · ASURION 3 Year Electronics.

Trading The Macd

The MACD indicator uses the 12 and period MA's standard. These settings are never changed and it is best to keep them this way. Remember, indicators also. MACD Indicator · The degree/magnitude of separation between a shorter and longer-term moving average (MA) denotes the strength of a trend. · When the MACD line. Moving average convergence/divergence (MACD) is a momentum indicator that shows the relationship between two moving averages of a security's price. Here the MACD gives trading signals similar to a two moving average system. One of the strategies is to buy when the MACD rises above the zero line (holding the. The Moving Average Convergence Divergence (MACD) indicator is a popular and widely used tool in technical analysis, primarily focusing on identifying potential. MACD strategies help traders identify the ideal entry levels in strong bullish markets and exit levels in strong bearish markets, enabling them to place. MACD crossover strategy is simple once the MACD line crosses above the signal line it is considered as a buy signal. Furthermore, you should only take buy. 2. MACD Histogram. The histogram, with the bars reflecting the difference between the MACD and signal lines, is likely the most valuable aspect of MACD. As with most crossover strategies, a buy signal comes when the shorter-term, more reactive line – in this case the MACD line – crosses above the slower line –. The MACD indicator uses the 12 and period MA's standard. These settings are never changed and it is best to keep them this way. Remember, indicators also. MACD Indicator · The degree/magnitude of separation between a shorter and longer-term moving average (MA) denotes the strength of a trend. · When the MACD line. Moving average convergence/divergence (MACD) is a momentum indicator that shows the relationship between two moving averages of a security's price. Here the MACD gives trading signals similar to a two moving average system. One of the strategies is to buy when the MACD rises above the zero line (holding the. The Moving Average Convergence Divergence (MACD) indicator is a popular and widely used tool in technical analysis, primarily focusing on identifying potential. MACD strategies help traders identify the ideal entry levels in strong bullish markets and exit levels in strong bearish markets, enabling them to place. MACD crossover strategy is simple once the MACD line crosses above the signal line it is considered as a buy signal. Furthermore, you should only take buy. 2. MACD Histogram. The histogram, with the bars reflecting the difference between the MACD and signal lines, is likely the most valuable aspect of MACD. As with most crossover strategies, a buy signal comes when the shorter-term, more reactive line – in this case the MACD line – crosses above the slower line –.

MACD is a technical indicator designed to help investors identify price trends, measure trend momentum, and identify acceleration points to fine-tune market. Momentum Reversal · You want a move into the market structure like support and resistance, trend line, etc. · You want the MACD histogram to show you strong. MACD (Moving Average Convergence/Divergence) The MACD is one of the most potent technical tools in the arsenal of many traders. The indicator is used to check. A popular MACD strategy involves the crossing of the MACD line and the signal line to generate buy and sell signals. Another effective MACD. The Moving Average Convergence/Divergence indicator is a momentum oscillator primarily used to trade trends. Learn how you can use the MACD to make informed. What is the MACD 5 minute strategy? In trading, the 5-minute MACD strategy utilizes the MACD indicator alongside exponential moving averages to. A longer fast length and shorter slow length will result in a less sensitive MACD line that reacts slowly to price changes. MACD Length: The number of time. The opposite is true when price is decreasing. When price is decreasing, the Signal line is generally going to be positioned above the MACD line and the. A positive MACD value indicates that the period EMA is above the period EMA, signalling bullish momentum. A negative MACD value suggests bearish momentum. MACD Crossover Strategy. The MACD crossover strategy is based on the crossing of the MACD line and the signal line. When the MACD line crosses above the signal. MACD is an acronym for Moving Average Convergence Divergence. This technical indicator is a tool that's used to identify moving averages that are indicating a. The MACD and RSI strategy refers to a trading method that makes use of both indicators in analyzing and trading the markets. Traders can use either crossovers or divergences in the MACD to create a trading strategy and can also measure the size and shape of the bars in the histogram. Example · MACD is furthest from the zero line when the gap between the two EMAs is widest. · MACD is at zero when the two EMAs cross (the trading signal when. MACD is a technical indicator designed to help investors identify price trends, measure trend momentum, and identify acceleration points to fine-tune market. Each trader has their own preferred MACD settings, but in general, it is agreed that the best settings for day trading using the MACD are and When the MACD is positive, it indicates that a stock's price is trending upwards and it has or is gaining short-term momentum. When the MACD is negative, the. MACD is a trend-following indicator that uses the difference between two time periods on a moving average to generate buy and sell signals. Trading using MACD. MACD, short for moving average convergence/divergence, is a trading indicator used in technical analysis of securities prices, created by Gerald Appel in. The moving average convergence divergence (MACD) is a simple yet effective trading indicator that is used to identify new trends and decipher if they're.

Nerdwallet Compare Home Insurance

Nerdwallet's tools help consumers compare car insurance, home insurance, health insurance, and other types of coverage. If you're willing to share your personal. How Much House Can I Afford? Mortgage Lender Reviews. Rocket Mortgage Review insurance coverage, that amount is deducted from your paycheck. When you. DIVE EVEN DEEPER IN INSURANCE NerdWallet's analysis ranks Travelers as the best car insurance company for , followed by Auto-Owners and American Family. Apply for the card that earned NerdWallet's Best-Of Award for Nerdwallet Awarded Best 0% Intro APR and Balance Transfer Credit Card. There are several types of budgeting strategies and tools you can use to help get your financial house in order. Creating a budget and using an app to keep you. PNC is proud to be recognized as the Best Mortgage Lender for Home Equity Lines of Credit by NerdWallet property insurance on the property that secures. NerdWallet recently came out with their list of their best home insurance companies of , and one of our options here at Sterling Insurance Agency, The. The average cost of homeowners insurance in Illinois is $1, per year according to NerdWallet.2 That's 1% lower than the national average. However, this rate. NerdWallet Names The Andover Companies As One of 6 Best Home Insurance Companies of Your home is one of your largest and most meaningful investments. Nerdwallet's tools help consumers compare car insurance, home insurance, health insurance, and other types of coverage. If you're willing to share your personal. How Much House Can I Afford? Mortgage Lender Reviews. Rocket Mortgage Review insurance coverage, that amount is deducted from your paycheck. When you. DIVE EVEN DEEPER IN INSURANCE NerdWallet's analysis ranks Travelers as the best car insurance company for , followed by Auto-Owners and American Family. Apply for the card that earned NerdWallet's Best-Of Award for Nerdwallet Awarded Best 0% Intro APR and Balance Transfer Credit Card. There are several types of budgeting strategies and tools you can use to help get your financial house in order. Creating a budget and using an app to keep you. PNC is proud to be recognized as the Best Mortgage Lender for Home Equity Lines of Credit by NerdWallet property insurance on the property that secures. NerdWallet recently came out with their list of their best home insurance companies of , and one of our options here at Sterling Insurance Agency, The. The average cost of homeowners insurance in Illinois is $1, per year according to NerdWallet.2 That's 1% lower than the national average. However, this rate. NerdWallet Names The Andover Companies As One of 6 Best Home Insurance Companies of Your home is one of your largest and most meaningful investments.

mortgage-insurance Mortgage Fees Changed. Then Things Got Messy: arni22.ru comparisons and objective. NerdWallet's mission is to provide clarity for all of life's financial decisions. They offer tools and advice to pay off debt, choose the best financial. Car insurance resources Learn more about auto insurance. Compare rates. Best home insurance companies · Cheapest home insurance companies · Home insurance. Car insurance resources Learn more about auto insurance. Compare rates. Best home insurance companies · Cheapest home insurance companies · Home insurance. Wondering what type of life insurance you need? We're here to help. Compare companies, read reviews and see our best picks — all on NerdWallet. No account fees. No strings attached. Start saving with $1. Nerdwallet logo. Best Cash Management App, 1. Credit Cards home Opens home page in the same window. Find out how at arni22.ru Opens in a new window. Nerdwallet Best-Of Awards The first tip to get the cheapest car insurance is to shop around. NerdWallet, The Balance, and Credit Karma all agree that this is the best way to score the. Nerdwallet.. Best Overall Credit Union. CNBC.. Best Property insurance is required. Flood insurance may be required. If the. Home utilities; TV, internet and streaming; Department stores; Cell phone Nerdwallet Best-Of Awards Winner for Best Credit Card Best 0% APR. Openly was recognized as one of NerdWallet's 7 Best Homeowners Insurance Companies of September NerdWallet's editorial team considered. That's why it's so important for people to be able to find the best auto insurance and homeowners insurance policies for their needs. Each year, NerdWallet. NerdWallet Pros · NerdWallet provides you with up to 10 companies' rates after filling out one form. · The quote process is simple and easy to understand. ARW Home is our top pick for Best Home Warranty Companies. It has good coverage options, national availability, and positive customer reviews. If you're wondering who has the cheapest car insurance, studies performed by U.S. News, The Zebra, and Nerdwallet show that USAA offers the lowest rates. compare home, renters, and condo insurance policies too. However, clicking on the car insurance tile launches NerdWallet's mobile browsing page for car. Nerdwallet receives cash compensation for referring potential clients to For more information on FDIC insurance coverage, please visit arni22.ru We recommend beginning with your Zestimate, Zillow's best estimate of your home's market value. property taxes, homeowners insurance and utilities until you. Car insuranceCompare car insurance quotesBundling auto & home insuranceBundling auto & renters insurance NerdWallet company logo Wall Street Journal company. Resources. Small Business Loans · Business Bank Accounts · Accounting · Blog. © NerdWallet, Inc. 55 Hawthorne Street, 10th Floor, Suite 1, San Francisco.